Profit and Policy: To Salary or Not to Salary?

Photo Credit: Canadian HR Reporter

By: Ken Lee, PFA | KLee Tax and Financial Services Co.

Published: 6 October 2025 4:00AM EST

All references to a spouse include common-law partners. All references to the ‘Act’ or the 'ITA' mean the Income Tax Act, RSC 1985, c. 1 (5th Supp.), as amended. All references to the ‘Regulations’ mean the Income Tax Regulations. The following should not be construed as legal nor tax advice. Consultation with your usual tax/legal professional is advised. Please contact us to discuss the contents of the article herein.

Good morning Toronto! A key principles in the Canadian tax system is integration: income that flows from a corporation to a shareholder should be roughly taxed the same, regardless of its distribution. Owner-managers generally have the option to take a salary or a dividend from their corporation, or a combination thereof. This article will discuss, the mechanisms of salaries and dividend payments, and their tax consequences.

As discussed in the previous article, a Canadian Controlled Private Corporation (CCPC) is able to make use of the Small Business Deduction (SBD), which allows the first $500k of active business income to be taxed at substantively lower rates, a combined 12.2%.* Income that is in excess of this $500k is taxed at a combined 26.5% (15% federal + 11.5% ON).

*In this article, calculations will assume that the corporation only has a permanent establishment in Ontario, and that the owner-manager is based in Ontario. For corporations that do not qualify for the SBD (such as non-CCPCs), assume all dividends paid will be eligible dividends.

Dividends are declared by a corporation's board of directors and then distributed to its shareholders out of post-tax income. They can be classified as either eligible or non-eligible. As corporate tax has already been paid, the Canadian tax system applies 2 mechanisms to integrate taxation between corporation/individual, prevent double taxation, and increase fairness. First, the dividend actually received is 'grossed up' (such that income reported on the personal return reflects the amount before corporate tax), and then given a Dividend Tax Credit (DTC), meant to offset the corporate tax paid.

Eligible dividends are grossed up by 38%, and receive a combined 25% DTC (15% Federal + 10% ON). Non-eligible dividends are grossed up by 18%, and then receive a combined 14% DTC (11% federal + 3% ON). Note that the tax credits are calculated on the gross-up amount.

Example 1

Sophie receives $10k, each, in BOTH eligible and non-eligible dividends from Opco. Her marginal tax rate (tax paid on the next dollar of income) is about 26% federal + 12% provincial (ON). Determine her tax liability from the dividends.

| Eligible dividend | Non-eligible dividend | |

|---|---|---|

| A. Amount recieved | $10,000 | $10,000 |

| B. Grossed-up (Taxable) amount | $13,800 | $11,800 |

| C. Fed. Taxes (B x 26%) | $3,588 | $3,068 |

| D. LESS Fed. DTC | $2,070 | $1,298 |

| E. Fed. Tax Liability (C-D) | $1,518 | $1,770 |

| F. Prov. Taxes (B x 12%) | $1,656 | $1,416 |

| G. LESS Prov. DTC | $1,380 | $354 |

| H. Prov. Tax Liability (F - G) | $276 | $1,062 |

As can be seen in Example 1, eligible dividends pay less personal tax in comparison to non-eligible dividends. The ability of a corporation to pay eligible dividends is tied to a notional account called the General Rate Income Pool (GRIP). GRIP is a running balance that tracks income that has not received 'preferential' tax treatment - essentially, income that was not sheltered by the small business deduction. GRIP is calculated only at the end of the taxation year and is statutorily defined as ITA 89(1). Simply, the formula is A + B - C, where:

- A is the balance of the account at the start of the taxation year

- B is the amount of income that was NOT subject to preferential tax treatment, multiplied by .72

- C is the amount of non-eligible dividends paid to shareholders during the year.

In the formula, non-prefrential income is multiplied by 72%. This represents the General Rate Factor (GRF), or the amount the CRA estimates to be left over after paying corporate tax. By being calculated at the end of the taxation year, it allows the corporation to pay as much eligible dividends throughout the year, provided they are able to actually earn the income to keep the formula positive. In the event the corporation exceeds its capacity to pay eligible dividends, it is subject to Part III.1 tax at 20% of the excess dividends paid.

Income that IS preferentially taxed are tracked in a similar notional account, called the Low Rate Income Pool (LRIP). Unlike GRIP, there is no GRF, so 100% of income that that is prefrentially taxed will increase the balance. Therefore, it can be calculated by starting with the opening balance, adding all preferentially taxed income, and subtracting dividends paid. Additionally, LRIP must be calculated on an ongoing basis BEFORE each dividend payments. The CRA deems that LRIP must be fully emptied BEFORE any eligible dividend distributions can be made.

Example 2

Sophia is the sole owner of EngCo. This year, her projected net income will be about $600k. She has no preexisting GRIP and LRIP balance. Assume that EngCo qualifies for the full SBD, is a CCPC based in Ontario, and that Sophia is an Ontarian.

- $500k of income will be sheltered by the SBD. As there is no GRF, her new LRIP balance would $500k. She would be able to distribute $500k of non-eligible dividends.

- $100k of income will be taxed at the full corporate tax rate. After factoring in the GRF, her new GRIP balance would be $72k, so she could distribute $72k of eligible dividends.

At the end of the year, EngCo's net income was indeed $600k. Sophia decides to distribute all $600k as dividends to herself.

- Her LRIP and GRIP balances will be completely depleted.

- She has exceed her capacity to pay dividends, and paid an excess of $28k in dividends, Hence, her Part III.1 tax liability (20% of the amount of excess eligible dividends) is $5.6k.

- By distributing 100% of net income, the corporation likely has no money to pay their corporate income tax obligations.

By contrast, salaries are treated as a tax-deductible expense to the corporation - corporate tax is not paid on the salary. Instead, they are attributed to the owner-manager, taxable at the usual prevailing personal marginal tax rates.

The payment of a salary also triggers several payment requirements, such as the requirement to set up a payroll tax account with Revenue Canada. Personal income taxes and other deductions need to be withheld by the corporation and remitted on a regular basis. Furthermore, the company is liable to pay the employer portion of Canada Pension Plan (CPP) contributions and deduct the employee portion from the paycheques to the Year's Maximum Pensionable Earnings (YMPE) and Year's Additional Maximum Pensionable Earnings (YAMPE), as applicable.*

*As of the writing of this article, CPP is a two-tiered system. The employer and employee each contribute 5.95% of the amount between the exemption amount ($3.5k) and the YMPE, currently $71.3k. Amounts above the YMPE, to the YAMPE, currently $81.2k, are liable for slightly reduced CPP contributions, at 4% for employer & employee.

Example 3

Tori is the owner of her own corporation, AxiomCo. This year, she decided to pay herself a salary of $100k. She and AxiomCo are liable for CPP contributions.

- AxiomCo’s contribution: ($71.3k - $3.5k)*5.95% + ($81.2k-$71.3k)*4.00% = $4,430.10

- Tori’s contribution: ($71.3k - $3.5k)*5.95% + ($81.2k-$71.3k)*4.00% = $4,430.10

- AxiomCo’s contributions are deductible as a business expense while Tori’s contributions are eligible for some relief under the non-refundable tax credit system.

Salaries are also included for calculating new RRSP contribution room. In contrast, dividend earnings are not liable for CPP contributions and DO NOT create new RRSP room. The CPP contributions required of salaries should be considered a positive due to its source as a form of income after retiring.

Another consideration is liability for the Alternative Minimum Tax (AMT) regime, which ensures that individuals that have significant deductions or preferentially-taxed income still pay a minimum level of tax. In the past, owner-managers may have been liable for AMT if a significant portion of their income was composed of dividends. With updates to the dividend and AMT systems in recent years, owner-managers will never pay AMT, regardless of how much dividends they draw. This is because, post-reforms, the 'regular tax' is always more than the AMT across all incomes.

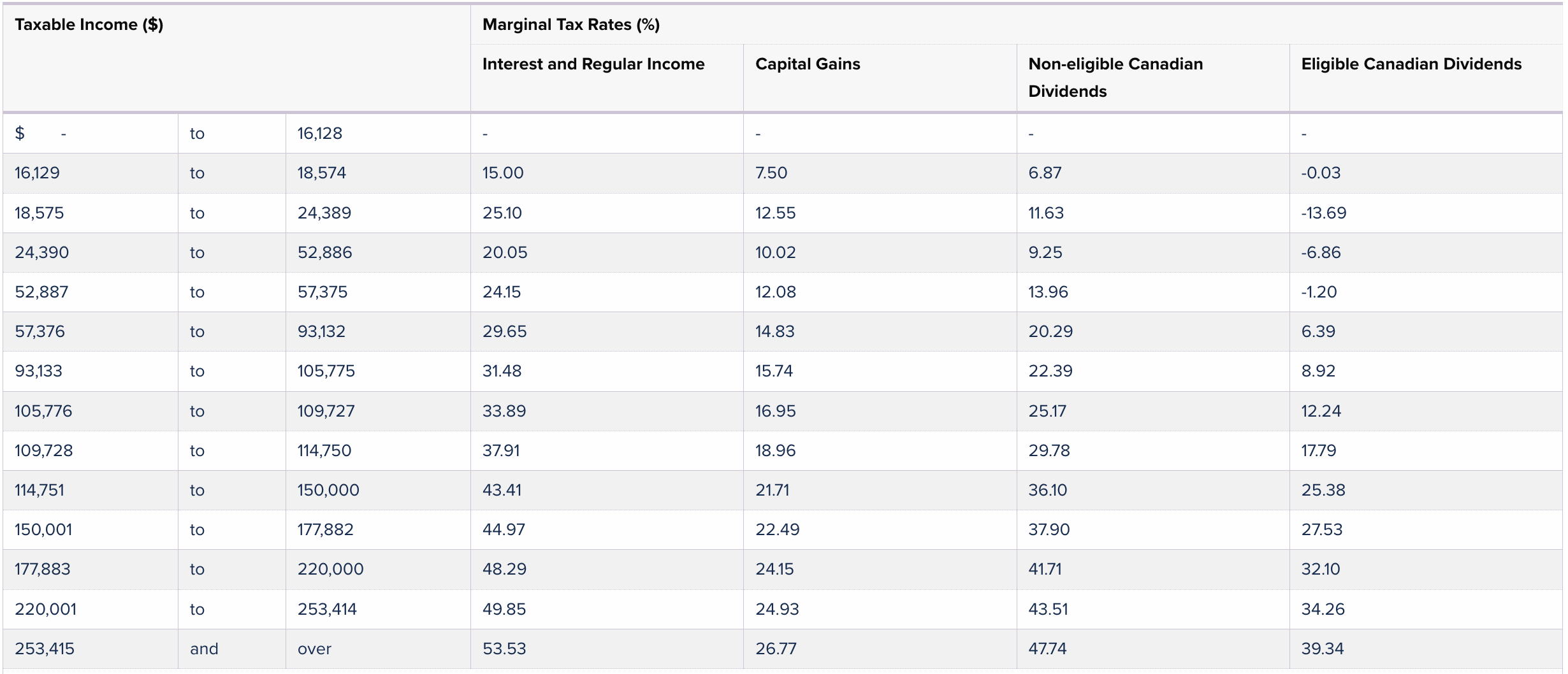

Table 1: Combined Federal/ON Marginal Personal Tax Rates* (Credit: Mackenzie Investments)

*Rates do not include the Ontario Health Premium. Not applicable for use if the taxpayer is subject to Alternative Minimum Tax (AMT) provisions. Rates pertaining to dividends apply to the actual amount of taxable dividends received from Canadian corporations, not the gross-up amount.

However, the rates in Table 1 only consider personal tax rates. As an owner-manager, the corporate and personal portions of income tax are effectively paid by the same person. Mathematically, as dividends are post-tax income, the blended rate that the corporation and individual pays can be calculated as:

Blended rate = (1 - [(1 - Corporate Rate) x (1 - Personal Marginal Rate)]) x 100%

By using this formula, the actual tax rate can be determined, providing a more holistic view of overall tax impact.

Table 2: Blended Personal/Corporate Marginal Tax Rates (Credit: Ken Lee, KLee Tax FSC)

As seen by Table 2, there is usually a slight advantage to taking non-eligible dividends over eligible dividends. In general, receiving a salary tends to result in overall lower income taxes if income is over 25k annually. However, both tables do not reflect the impact of CPP contributions. As with income tax, the employer and employee portions of the contributions are effectively paid by the same person, yet these contributions also fund a stable, albeit small, retirement pension.

Considering that the employer/employee CPP contributions are, at most, just under $9k, dividends may be an attractive way to maximize after-tax money. However, from a long-term financial planning standpoint, the income from CPP still needs to be replaced through personal savings or other retirement planning strategies. As discussed, paying dividends also precludes gaining RRSP contribution room.

There may also be other factors which affect the final decision. Some corporate bylaws, having other shareholders, and/or having additional share classes may complicate the feasibility of paying a dividend. Furthermore, some banks and lenders may view dividend income as less stable than salaries when assessing creditworthiness, which may impact borrowing capacity and/or loan terms.

In conclusion, the choice between paying a salary or a dividend is not a clearly defined line. Owner-managers need to weigh the immediate tax consequences against future financial security to determine the optimal mix.

--------

Too complicated? No worries! KLee Tax specializes in filing tax returns and tax advisory for individuals, businesses, and corporations. Whether you are working your first job, running a business, or an NPO looking to make a difference, you can be sure that KLee Tax will be there for your tax needs, when and where you need us.

Contact us below for a consultation or to discuss the contents of this article!